Introduction

Climate change ab sirf ek environmental concern nahi raha — iska direct impact humari economy, safety, aur personal finances pe pad raha hai. USA me homeowners ke liye ek major challenge hai insurance rates ka constant increase, jo kaafi had tak extreme weather events ki wajah se ho raha hai.

2025 me kaafi states me home insurance premiums unprecedented level tak badh gaye hain, aur kuch companies ne high-risk areas me policies dena band bhi kar diya hai. Aaj hum dekhenge ki climate change kaise home insurance rates ko affect kar raha hai, aur aap apne home aur finances ko kaise protect kar sakte ho.

Table of Contents

The Link Between Climate Change and Home Insurance

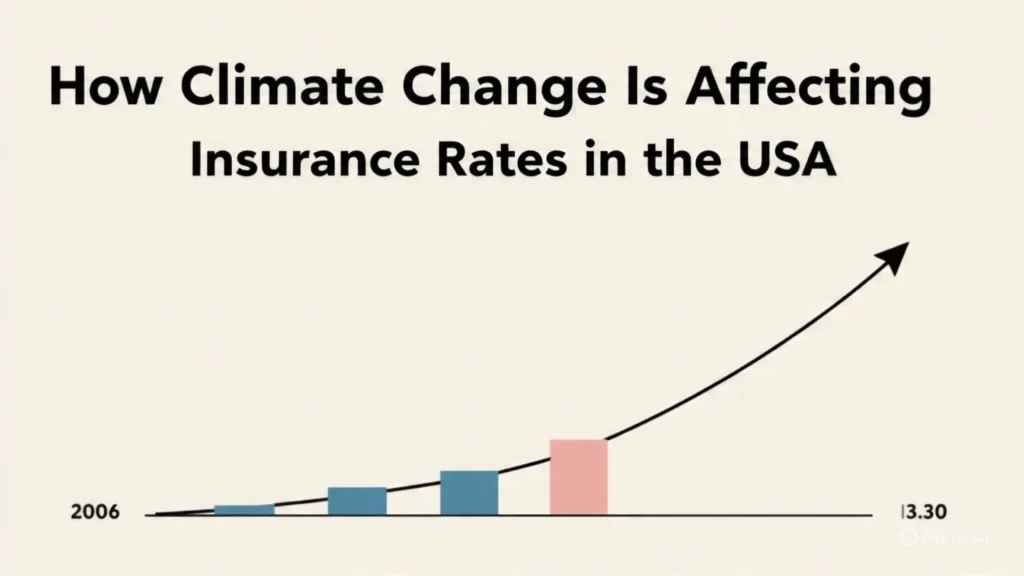

1. Rising Frequency of Natural Disasters

Pichle kuch saalon me hurricanes, wildfires, floods, aur severe storms ka frequency badh gaya hai. Insurers ko har claim ke baad zyada payout karna padta hai, jisse unke loss ratio badhte hain aur wo premium increase kar dete hain.

📌 Example: Florida aur Louisiana me hurricane season ke baad homeowners insurance rates 20–30% tak badh gaye.

2. Increasing Cost of Repairs and Rebuilding

Climate change sirf damage ka risk hi nahi badha raha, balki construction material aur labor costs bhi badha raha hai — jo insurance payout ko aur mehenga banata hai.

3. Reinsurance Costs Going Up

Insurance companies khud apna risk cover karne ke liye reinsurance leti hain. Jab climate change ki wajah se losses badte hain, to reinsurance ka cost bhi upar chala jata hai, jo ultimately homeowners pe pass ho jata hai.

States Most Affected by Climate Change in 2025

| State | Main Risk Factor | Avg. Premium Increase (2024–2025) |

|---|---|---|

| Florida | Hurricanes & Flooding | 28% |

| California | Wildfires | 22% |

| Texas | Severe Storms & Hail | 19% |

| Louisiana | Hurricanes | 27% |

| Colorado | Wildfires & Hail | 17% |

💡 Note: High-risk zones me premiums double tak ho sakte hain agar mitigation measures na liye gaye ho.

Why Some Insurers Are Leaving Certain Markets

Kuch insurance companies ne high-risk states me new policies dena ya renew karna band kar diya hai kyunki:

- Losses premium collections se zyada ho gaye

- Risk ka predict karna mushkil ho gaya hai

- Reinsurance ka cost uncontrollable ho gaya hai

📌 Example: 2023–2025 me multiple major insurers ne California me wildfire-prone areas se withdraw kar liya.

Impact on Homeowners

- Higher Premiums – Annual cost me $500–$2,000 tak ka jump possible hai.

- Coverage Limitations – Kuch policies specific perils ko exclude kar rahi hain.

- Need for Supplemental Policies – Flood aur earthquake coverage alag se lena padta hai.

- Difficulty in Finding Coverage – High-risk zones me approved insurers kam ho rahe hain.

How to Lower Your Home Insurance Premiums Despite Climate Risks

1. Invest in Home Hardening

- Fire-resistant roofing material lagao.

- Storm shutters install karo.

- Flood barriers ya sump pumps use karo.

2. Maintain Your Property

- Trees trim karo jo storm damage cause kar sakte hain.

- Roof, gutters, aur siding ka regular inspection karao.

3. Shop Around and Compare

- Multiple insurers ka quote lo.

- Local mutual insurance companies consider karo.

4. Bundle Your Policies

Auto + home insurance ek company se leke multi-policy discount lo.

5. Increase Deductible

Higher deductible choose karke annual premium kam kiya ja sakta hai (lekin claim time pe out-of-pocket zyada hoga).

Government and Industry Response

- State-backed Insurance Pools – High-risk homeowners ke liye last-resort coverage.

- Climate Risk Modeling – Advanced AI tools se risk prediction improve ho raha hai.

- Building Code Updates – Stronger construction standards to withstand extreme weather.

Future Outlook (2025 and Beyond)

- Premium Volatility – Weather patterns unpredictable hone ki wajah se rates fluctuate karte rahenge.

- More Parametric Insurance – Fixed payout models for specific events (jaise hurricane landfall).

- Focus on Resilience Discounts – Jo homeowners protective upgrades karenge, unko better rates milenge.

Conclusion

Climate change ne USA ke home insurance landscape ko permanently shift kar diya hai. Higher premiums, reduced coverage options, aur market withdrawals ka trend shayad agle kuch saalon tak chale. Lekin proactive measures, smart shopping, aur resilience-building upgrades karke aap apne ghar aur finances ko better protect kar sakte ho.

FAQs

Q1: Kya climate change har state me insurance rates ko affect kar raha hai?

Har state ka impact alag hai, lekin coastal aur wildfire-prone states me zyada premium hikes ho rahi hain.

Q2: Kya flood insurance normal home insurance me included hota hai?

Nahi, flood insurance usually separate FEMA-backed NFIP policy hoti hai.

Q3: Kya green home upgrades se premium kam ho sakta hai?

Haan, energy-efficient aur disaster-resistant upgrades se discounts mil sakte hain.